International Trade Finance

FITTskills: International Trade Finance provides an introduction to an important but poorly understood element of international commerce: trade finance. Payment, risk mitigation and financing, as well as access to timely information - about both the financial flow and the flow of goods and services - are all areas of concern for both importers and exporters.

In addition to understanding the financial elements of international trade, providing or gaining access to competitive trade finance is a critical element in enabling and facilitating the successful conclusion of international trade transactions.

While the core principles and practices related to the finance of international trade have been in existence for hundreds of years, the advent of new enabling technologies—including the Internet—is slowly but inexorably reshaping the nature of trade finance. These new technologies introduce a range of options for international traders and provide faster access to information while working to preserve and enhance the fundamental value of trade finance practices, techniques and mechanisms.

After completing this course in trade finance, you will have acquired a solid understanding of the “Four Pillars” of trade finance: payment facilitation, risk mitigation, financing and the provision of timely information. In addition, you will understand the basic characteristics and mechanics related to trade finance products, services and transactions.

It should be noted that this is not a finance course in the traditional academic sense, and will not focus on defining fundamental concepts in finance and accounting, such as cashflow, working capital and financial ratios.

The treatment of the subject strikes a balance between rigorous attention to principles and theory and practical insights and observations, which will prove useful - perhaps even critical - to your activities in international trade. Topics covered in this introductory course include the following:

- Trade finance products

- Short-, medium - and long-term trade finance

- Credit risks and mitigation

- Technology and trade finance

- Export credit agencies (ECAs)

- Planning the financial elements of trade finance

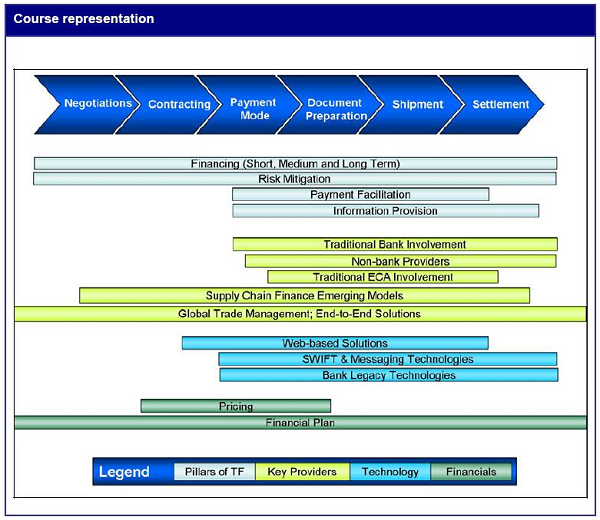

The graphic that follows provides one view of the interrelationship of the major topics covered in this course, with direct reference to a basic international trade transaction, from negotiations through to settlement.

The arrows at the top of the graphic represent typical steps in a trade transaction – from negotiations between buyer and seller, to contracting, selection of payment mode, export document preparation, to shipment of goods, and finally, settlement of the transaction.

The bars below, grouped into four sets (pillars of trade finance, key providers of trade finance, technology, and financials), represent the extent to which each element ‘spans across’ the life of a transaction. SWIFT and messaging technologies, for example, are most relevant from the Payment Mode through to Settlement, whereas GTM or Global Trade Management extends across the full life of a transaction, and beyond the ‘Negotiation-through-Settlement’ view depicted here.

The graphic is not comprehensive, nor does it address every possible nuance or combination of characteristics in a transaction, but it is intended to illustrate the interplay between the major elements of the text which follows.

It is worth highlighting that trade finance banks have historically focused their activities in the post-contracting portion, primarily in the selection and enabling of a mode of payment, and in the settlement of a transaction. Certain banks later became engaged in document preparation, and the latest models extend across the full cycle of a transaction.

It is worth highlighting that trade finance banks have historically focused their activities in the post-contracting portion, primarily in the selection and enabling of a mode of payment, and in the settlement of a transaction. Certain banks later became engaged in document preparation, and the latest models extend across the full cycle of a transaction.

While it is legitimate to note that certain components are in reality a combination of two or more others (Global Trade Management is an emerging ‘provider’ model, very closely tied to technology platforms), the intent of the graphic is simply to provide a representation of the course content.

Whatever your objective is in attending this course—for general information, as a prospective Certified International Trade Professional (CITP), to build your career or to expand your business—your investment of time and effort in attending this course will be worthwhile. It will undoubtedly make you more effective in understanding and managing the financing aspects of international trade.

The textbook addresses numerous concepts and elements of trade finance from different points of view: you will learn about payment options and their various features, and will see those same options discussed from a risk management and mitigation perspective as well, for example. Both views are intrinsic to the financing of international trade.

We should also note at the outset that certain definitions and expressions commonly used in trade finance involve some variations which may appear contradictory, but are well known to industry professionals, and you will be well served to be aware of such detail, which could otherwise prove difficult to interpret.

Examples here include the exact definitions of short-, medium-, and long-term finance (there is no exact definition, but we have provided a guideline), as well as the use of expressions such as documentary letter of credit, documentary credit or letter of credit—all of which essentially refer to the same type of trade finance instrument.

This textbook is intended to provide a conceptual view as well as practical insight into trade finance, in the context of a professional trade training program. It is not intended, on its own, to train future trade bankers in the transactional intricacies involved in verifying export documents against trade finance instruments, but it will ensure a solid overview of key issues, risks and opportunities around the financing of international trade.

It will be helpful to bear in mind that, like a sale and a purchase, an export and an import are simply “two sides of the same coin.” At the core of trade finance is the reality that the exporter wishes to ensure prompt and secure payment. The importer wishes to ensure that payment is authorized only once assurance is provided that the goods purchased have been shipped and will be received as agreed.

Banks act as intermediaries between an importer and an exporter, having devised numerous products and services with a series of features—all of which work to facilitate the objectives of importer and exporter.

Beyond the pure payment aspect, trade finance also provides importers and exporters with several products and techniques that allow for access to various forms of financing—basically, loans—that can be used by exporters to produce the goods for eventual export, or permit the importer to sell the goods purchased, generate the intended profit, then pay for the cost of acquiring the goods, for example.

As you become familiar with the various products, services and instruments related to trade finance, consider each (and the variations of each) from the perspective of importer, exporter and financial institution. This will help you appreciate the interrelationships at play and the reality of the “two sides of one coin.”

Knowledge of trade finance translates directly to financial benefit for international traders through enhanced negotiating positions and tactics, risk-mitigation techniques that can literally save a company from bankruptcy, and improved management of cash flow and working capital through effective use of financing alternatives.

Knowledge gaps in trade finance can prove disastrous, and this course takes significant steps to provide insight into international trade finance, reducing the risk in your international ventures and contributing demonstrably to the bottom line through lower cost financing, reductions in losses and a generally more informed, effective approach to handling the financial side of international trade.

Whatever your objective is in attending this course—for general information, as a prospective Certified International Trade Professional (CITP), to build your career or to expand your business—your investment of time and effort in attending this course will be worthwhile. It will undoubtedly make you more effective in understanding and managing the financing aspects of international trade.

The textbook addresses numerous concepts and elements of trade finance from different points of view: you will learn about payment options and their various features, and will see those same options discussed from a risk management and mitigation perspective as well, for example. Both views are intrinsic to the financing of international trade.

We should also note at the outset that certain definitions and expressions commonly used in trade finance involve some variations which may appear contradictory, but are well known to industry professionals, and you will be well served to be aware of such detail, which could otherwise prove difficult to interpret.

Examples here include the exact definitions of short-, medium-, and long-term finance (there is no exact definition, but we have provided a guideline), as well as the use of expressions such as documentary letter of credit, documentary credit or letter of credit—all of which essentially refer to the same type of trade finance instrument.

This textbook is intended to provide a conceptual view as well as practical insight into trade finance, in the context of a professional trade training program. It is not intended, on its own, to train future trade bankers in the transactional intricacies involved in verifying export documents against trade finance instruments, but it will ensure a solid overview of key issues, risks and opportunities around the financing of international trade.

It will be helpful to bear in mind that, like a sale and a purchase, an export and an import are simply “two sides of the same coin.” At the core of trade finance is the reality that the exporter wishes to ensure prompt and secure payment. The importer wishes to ensure that payment is authorized only once assurance is provided that the goods purchased have been shipped and will be received as agreed.

Banks act as intermediaries between an importer and an exporter, having devised numerous products and services with a series of features—all of which work to facilitate the objectives of importer and exporter.

Beyond the pure payment aspect, trade finance also provides importers and exporters with several products and techniques that allow for access to various forms of financing—basically, loans—that can be used by exporters to produce the goods for eventual export, or permit the importer to sell the goods purchased, generate the intended profit, then pay for the cost of acquiring the goods, for example.

As you become familiar with the various products, services and instruments related to trade finance, consider each (and the variations of each) from the perspective of importer, exporter and financial institution. This will help you appreciate the interrelationships at play and the reality of the “two sides of one coin.”

Knowledge of trade finance translates directly to financial benefit for international traders through enhanced negotiating positions and tactics, risk-mitigation techniques that can literally save a company from bankruptcy, and improved management of cash flow and working capital through effective use of financing alternatives.

Knowledge gaps in trade finance can prove disastrous, and this course takes significant steps to provide insight into international trade finance, reducing the risk in your international ventures and contributing demonstrably to the bottom line through lower cost financing, reductions in losses and a generally more informed, effective approach to handling the financial side of international trade.